Blog

March 1, 2010 | Authored by: Vindicia Team

Billing System Economics

When evaluating billing solutions, companies have a lot of information to sort through and little help to do so.

After talking with countless merchants, I’ve found that companies typically fall into two categories during their search – startup or veteran. Startup companies aren’t necessarily those who just launched their business, but any company that is bringing a new product to market and lacks pre-existing infrastructure or payment expertise falls into this category. Veterans have built a system at least once before and are very aware of the pitfalls and the overall payments ecosystem.

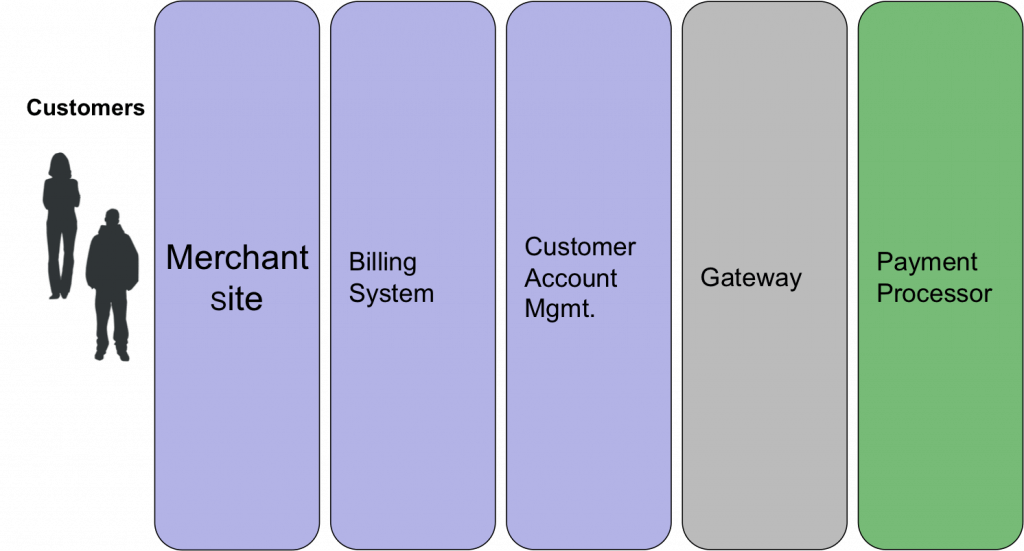

Startup companies should spend the time to educate themselves on the industry – payments and billing are complex and outright confusing. The diagram below shows the many different pieces of a complete billing infrastructure.

The systems above are involved when a customer makes their purchase until the transaction is submitted to the customer’s bank (that issued the credit card or funds the payment source) and eventually money ends up in the companies bank account. A further description of these systems, and how outsourced billing systems add value are after the jump.

- Merchant Site – The merchant website will have several components including the order page where customers enter their information, self-support areas, and access to products.

- Billing System – In-house or outsourced system that is used in conjunction with the Customer Account Management system for tracking when and how much to charge each customer (recurring billing) and storing the customer’s payment information, billing history and product entitlement.

- Gateway – The piece that is responsible for submitting transactions to the payment processor, along with calculating applicable taxes. Gateways also usually provide “tokenization” or encrypted storage of customer payment information.

- Payment Processor – A service that is integrated into the Visa/Mastercard network and presents transactions to the issuing banks and also performing currency conversion if necessary. The payment processor is also where the merchant will the money that comes into their bank account.

Startup companies typically focus on the processing as the major cost – the combined gateway fee and payment processing fee. The danger of focusing on cost as a primary decision point is the tendency to overlook other valuable services and features that are added throughout the payments ecosystem. The items typically overlooked include credit card chargebacks (and the associated 1% limits), fraud screening, customer retention (billing retry cycles), Account Updater, promotional offerings and affiliate management.

Veteran companies fully understand the issues with building and integrating a billing system into internal systems and 3rd parties. In the past few years, this in-house exercise has become even more difficult due to the additional security and privacy restrictions that result from PCI DSS compliance. The areas that veteran companies typically are skeptical of when looking at outsourcing their billing include automation gains, reduction rate of “passive opt-outs”, increased promotional capabilities and trial customer conversion rate increases.

The value of an outsourced system lies in the application of best-practices and focus on the specific areas of functionality that accompany customer billing. Specifically, best-in-class 3rd party billing systems provide return on initial investments in the following areas:

- Quickly launch new products, free trials, promotional offers and marketing campaigns to capture new customers

- Experiment with the business models that work best for your business

- Accept multiple payment methods & currencies to convert more trial users into paying

- Communicate to prospective and current customers at the right time and in their preferred language

- Retain more customers with account updater integrations and billing retry logic

- Allow up-sells and cross-selling to existing customer base for greater profits and customer satisfaction

- Enable customer service to see billing history and take appropriate actions

- Limit losses due to fraud, chargebacks and “double dipping”

- Reduce burden of compliance with PCI DSS

- Handle calculation and reporting of sales tax & VAT including exemptions

- Provide peace of mind that your billing system will reliably process billing on your behalf

- Optimize your business with detailed reports and analytics and a team of knowledgeable experts

While many of the benefits described above are “soft benefits” the ROI for a 3rd party billing system is extremely compelling even if companies just focus on the returns from increasing customer acquisition and retention. A 6%-10% annual increase across acquisition and retention is easily achievable and will make the system pay for itself many times over in the first year alone.

About Author

Vindicia Team

We value our subject matter experts and the insights each of them brings to the table. We want to encourage more thought leaders to come together and share their industry knowledge through our blog. Think you have something interesting to contribute as a guest blogger? Contact us at info@vindicia.com