Over the past two months, we've fielded a lot of questions about the impact of the Amex-Costco breakup. (See my earlier post on this topic.) Clients and prospects alike want to know, "How did it affect my business?" and equally important, "What is normal?" We've been discussing this on an individual basis, but it's worth sharing with the wider community.

For merchants who skew towards monthly renewals, you should be past the impact now. Merchants who have a higher percentage of annual renewals, the process will continue to play out.

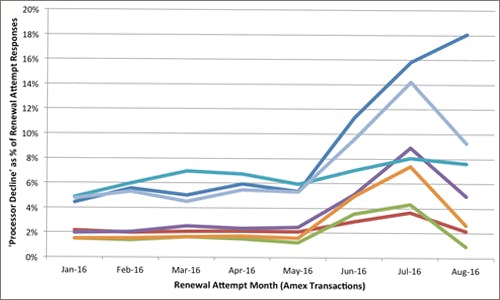

Our analytics team pulled together the following graph that highlights seven large merchants. The spike in "Processor Decline" is very clear. It starts in June and it peaks in July. By this point, most of those monthly renewals have worked their way out of the system. The dark blue line in the graph is for a merchant with a much higher annual mix in their client base.

This is fairly easy data for us to gather, but it's one of the benefits of a good hosted billing system like CashBox. Even our largest clients want to know "What is normal?" By looking across our merchant base, and isolating specific information, we're able to answer that question.

(Hat tip to Frank Jimenez in our Revenue Optimization practice for the data and graph.)