Vindicia in the News

Bean Box CEO: Lack of product options puts subscription sales at risk

Feb 7, 2023 | By PYMNTS.com

Economic worries, such as stagnant wages, increasing interest rates and inconsistent inflation, are piling up on consumers, forcing them to examine their spending. As they adjust, subscriptions are likely to be on the chopping block, making it increasingly vital for subscription-based companies to avoid cancellations. Whether due to expired or stolen credit cards or errors in payment data entry, failed transactions are a leading culprit for subscription cancellations.

Some subscription companies are dealing with this challenging environment by making cuts. There are, however, solutions that can help protect and even grow revenue through smart management of subscription cancellations. Proactive customer retention is less costly than suffering a loss and figuring out how to make it up.

The “Subscription Commerce Tracker®” explores how subscription companies can increase customer loyalty and lifetime value by working on solutions to recover failed payments, helping these companies stay competitive.

Around the subscription commerce space

The recurring revenue of subscriptions is highly attractive to companies dealing with difficult economic times, especially considering how it’s easier to convert an existing customer than a new prospect. Subscriptions also enable bundled products with different combinations that can help increase average order value.

Consumers feel the pinch of inflation and are most concerned with cost-of-living relief. With prices set to be approximately 10% higher than in 2021, subscription firms should stay close to customers to better understand their price sensitivity.

For more on these and other stories, visit the Tracker’s News and Trends section.

An insider on making subscriptions work in tough times

For direct-to-consumer (D2C) companies, subscriptions are key to achieving growth when competing against brands more established in traditional channels. Rising inflation will challenge subscription models, as prices will likely increase along with it. To succeed, brands must address their business model and integrate other approaches, such as a la carte purchasing or gift models, while removing checkout friction and reducing failed payments.

To get the Insider POV, we spoke with Matthew Berk, CEO at Bean Box, to learn more about how D2C and other subscription-driven brands can retain customers during these uncertain economic times.

Recovering failed payments to supercharge customer lifetime value

It is much easier to retain a customer than win over a new one. Many businesses are investing in retention strategies to battle cancellations, both deliberate ones and those brought on by failed payments. Companies are increasingly using artificial intelligence and machine learning to determine which transactions might be problematic and how to smooth them out.

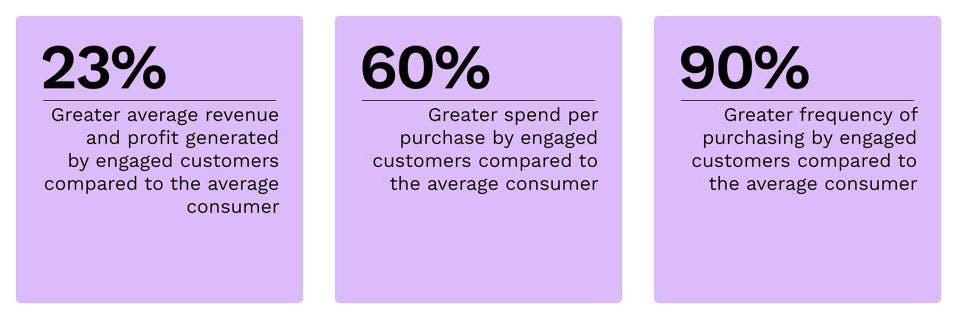

Recovering failed payments to retain customers can boost customer lifetime value, which will be crucial in maintaining healthy revenues. As brands look to navigate a challenging economy this year, customer retention will be a priority, as engaged customers buy more frequently, spend more each time they purchase and enable 23% more revenue and profit than the average consumer.

To learn more about how recovering failed payments can help subscription firms weather 2023, read the Tracker’s PYMNTS Intelligence.

About the tracker

The “Subscription Commerce Tracker®,” a collaboration with Vindicia, examines why subscription companies must address failed payments to drive customer loyalty and make subscriptions work as consumers and businesses face an uncertain economy.