How failed payment data can optimize your subscription business for endless growth

Learn how to leverage failed credit and debit card payment data to strengthen your subscription business. Discover which types of failed transaction data to analyze, and uncover strategies that improve outcomes for subscription, membership, and recurring revenue models. Explore solutions that help recover lost payments, reduce passive churn, and protect long-term growth.

In this guide we’ll explore:

1. What is failed payment data analysis?2. Why is failed payment data analysis important?3. What types of transaction data should be analyzed?4. How do you leverage payment failure data to improve business outcomes?5. What is the process to analyze past payment failures?6. What are the reasons that transactions fail?7. What if you don’t have the technical expertise in-house?8. What is payment intelligence?9. What is Vindicia Retain failed payment recovery?10. How to calculate the benefits of failed payment recoveryWhat is failed payment data analysis?

For subscription businesses, failed payment data analysis is the process of examining and interpreting information from declined credit and debit card transactions. By analyzing failed payment data, businesses can uncover the causes of payment friction, identify recurring patterns, and extract insights to improve authorization success rates and reduce future failures.

Typical analysis includes reviewing data such as issuer error codes, transaction details, subscriber information, payment methods, and the timing of declines. With this insight, subscription businesses gain a deeper understanding of why payments fail and can take targeted action to minimize disruptions, recover lost revenue, and strengthen customer retention.

Why is failed payment data analysis important?

Failed payment transactions directly affect your bottom line by reducing immediate revenue. For subscription, membership, and recurring revenue businesses, the impact is even greater: each failed payment risks passive churn, where the subscriber leaves and future recurring revenue is lost.

By analyzing failed payment data, businesses can identify common issues, trends, and patterns behind payment declines. These insights make it possible to implement targeted strategies that minimize failures, recover lost revenue, and protect long-term growth.

Example: If your subscription business generates $500,000 in monthly recurring revenue, a 2% reduction in failed payments protects an additional $10,000 each month—or $120,000 annually—that would otherwise be lost.

What types of transaction data should be analyzed?

To leverage failed payment data for revenue recovery and customer retention, subscription businesses should examine key areas such as:

- Reasons for Payment Failures: Review issuer error codes to identify the main causes of declines. Common reasons include insufficient funds, expired cards, incorrect details, fraud suspicion, technical errors, or provider issues.

- Payment Methods and Timeframes: Analyze whether certain payment methods or billing cycles are more prone to failures. Identifying these trends helps reduce passive churn and prevent recurring issues.

- Subscriber Information: Examine customer details linked to failed transactions. This can highlight recurring payment issues, potential fraud, or demographic segments at higher risk of friction—allowing tailored recovery strategies.

- Payment Processes: Investigate weaknesses in your transaction flow, such as gateway limitations, processor errors, or checkout friction. Addressing these gaps can reduce failures and improve the customer experience.

Payment failures lead to both immediate and long-term revenue loss. By quantifying the financial impact through failed payment data analysis, businesses can understand the scale of the problem and act decisively. Strategies such as optimized retry processes, personalized notifications, or offering alternative payment options can recover revenue and minimize subscriber churn.

How do you leverage payment failure data to improve business outcomes?

Analyzing past payment declines gives subscription businesses valuable insights into customer behavior, payment trends, and process gaps. These insights can be applied to improve payment success rates, reduce churn, and enhance subscriber satisfaction. Key applications include:

- Strengthen Subscriber Communication & Retention: Use failed payment data to trigger proactive communications such as automated emails or notifications. Clear instructions help customers resolve issues quickly, reducing passive churn and preserving the customer experience.

- Optimize Business Processes: Identify patterns in payment failures by day, month, or season to uncover billing cycle issues. If certain gateways or providers consistently show higher decline rates, explore alternatives or address integration challenges.

- Develop Targeted Strategies: Spot customer segments or regions more prone to payment friction. Offer alternative payment methods, flexible options, or reminders tailored to these groups to improve transaction success rates.

- Enable Predictive Analytics: Over time, payment failure data can be used to build predictive models. These models highlight which subscribers are at risk of future declines, allowing proactive actions such as outreach before renewal cycles.

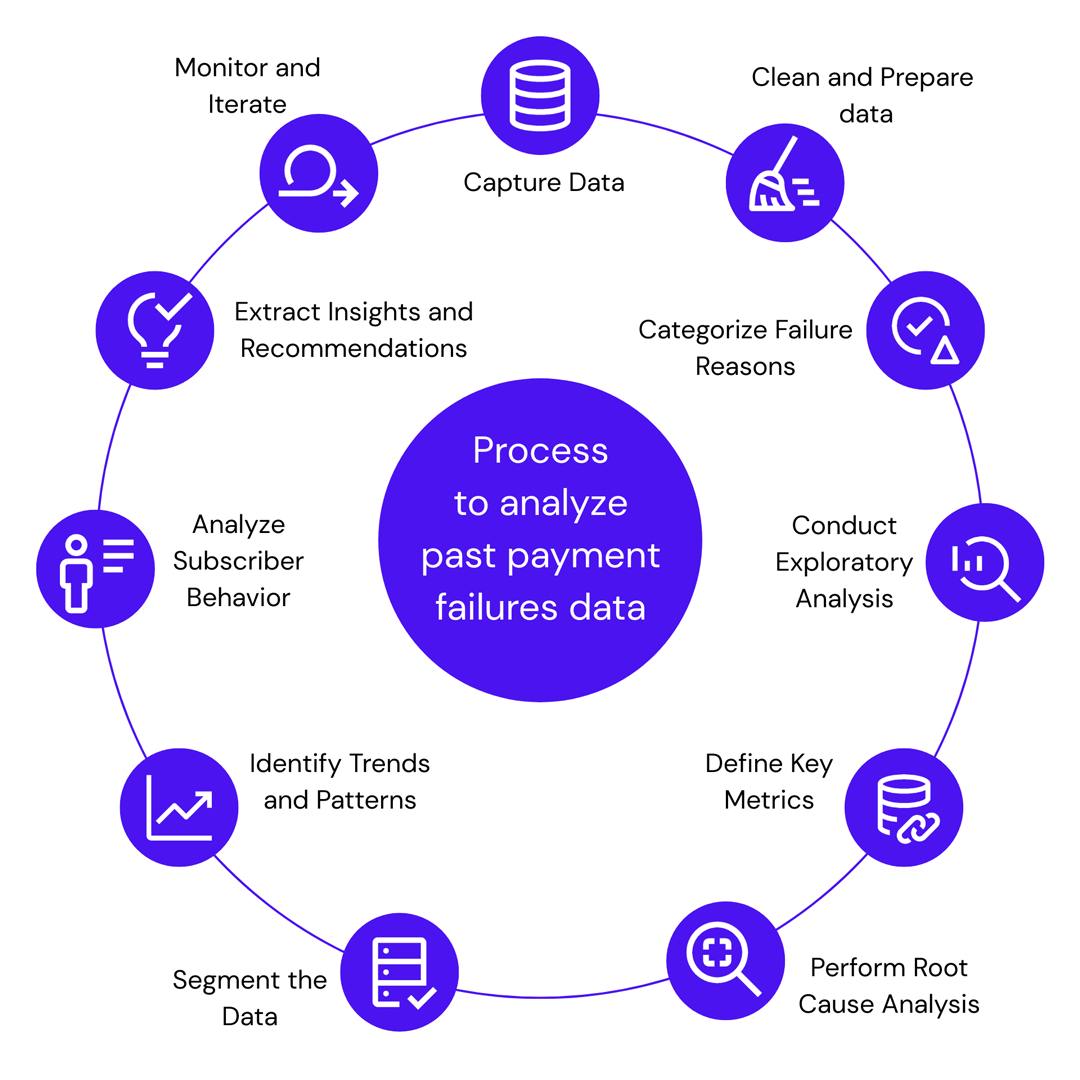

What is the process to analyze past payment failures?

For subscription and recurring revenue businesses, analyzing past payment failures involves a structured process. Key steps include:

- Capture Data: Collect details from failed transactions, including error codes, subscriber information, payment methods, and timestamps.

- Clean and Prepare Data: Ensure accuracy by removing duplicates, correcting inconsistencies, and formatting data for analysis.

- Categorize Failure Reasons: Use issuer error codes to classify the main causes of declines, helping to identify common failure themes.

- Conduct Exploratory Analysis: Visualize data, calculate statistics, and look for early insights such as trends or anomalies.

- Define Key Metrics: Track metrics like total failed transactions, revenue lost, and failure percentage compared to successful payments.

- Perform Root Cause Analysis: Investigate deeper by examining subscriber traits, transaction details, payment provider performance, or fraud signals.

- Segment the Data: Break down results by attributes such as demographics, payment methods, or transaction types to spot unique patterns.

- Identify Trends and Patterns: Look for recurring issues tied to billing cycles, time of year, or product categories that trigger higher failure rates.

- Analyze Subscriber Behavior: Assess common traits among subscribers who experience failures, such as high-risk profiles or spending patterns.

- Extract Insights and Recommendations: Turn findings into actions—optimize payment processes, strengthen fraud prevention, improve customer support, or educate subscribers.

- Monitor and Iterate: Track performance after changes, refine strategies, and repeat the process to improve long-term payment success rates.

By following these steps, subscription businesses can uncover the root causes of payment failures, recover lost revenue, reduce churn, and enhance the overall customer experience.

What are the reasons that transactions fail?

Understanding why card payments are declined is a critical part of failed payment data analysis. Credit and debit card transactions can fail for many reasons. The most common include:

- Expired Card: Payments are declined if subscribers use cards past their expiration date.

- Insufficient Funds: The cardholder’s account lacks the funds or available credit to complete the transaction.

- Invalid Card Information: Errors in the card number, CVV, billing address, or expiration date can cause declines.

- Canceled or Inactive Card: Cards may be canceled for theft, fraud, delinquency, or inactivity. New cards must also be activated before use.

- Suspected Fraud: Issuers flag unusual activity (large charges, foreign locations, multiple quick attempts) and may block the transaction.

- Daily Spending Limits: Transactions exceeding cardholder or issuer-imposed limits are automatically declined.

- Other Cardholder Restrictions: Subscribers may set merchant, geographic, or transaction-type restrictions that trigger declines.

- Overlapping Transactions: Multiple rapid transactions, especially high-value, can trigger issuer fraud-prevention blocks.

- Technical Issues: Network errors, gateway interruptions, or processor outages can result in temporary declines.

- Blocked or Suspended Card: If reported lost, stolen, or compromised, the card is suspended until reactivation.

- Closed Account: Transactions will fail if the cardholder’s account has been closed by them or the issuer.

What if you don’t have the technical expertise in-house?

Many subscription and recurring revenue businesses lack the staff, expertise, or bandwidth to perform in-depth analysis of failed payment transactions. In these cases, the most effective approach is to partner with a specialized solution that handles the complexity for you.

Vindicia Retain integrates seamlessly with existing billing platforms and payment processors to recover failed payments automatically. Using decades of payment data and advanced machine learning, Retain helps businesses reduce churn, recover lost revenue, and improve customer retention—without requiring internal technical resources.

What is payment intelligence?

Payment Intelligence is the foundation of Vindicia Retain, combining advanced machine learning with decades of payments expertise to help subscription businesses recover failed transactions and reduce churn. By analyzing billions of payment records, Payment Intelligence turns failed transaction data into actionable insights that optimize recovery and protect recurring revenue.

Payment Intelligence works around the clock, providing data-driven guidance that improves payment success rates and strengthens customer retention—without disrupting the subscriber experience.

Backed by over 20 years of payments expertise, Vindicia’s Payment Intelligence operates at unmatched scale:

- $78 billion processed

- 1.8 billion transactions

- 420 million digital accounts

- 702 million payment accounts

With Payment Intelligence, businesses gain a deep understanding of their failed payment ecosystem and the ability to act on it—staying one step ahead in retaining customers and accelerating growth.

What is Vindicia Retain failed payment recovery?

Vindicia Retain is the subscription industry’s leading failed payment recovery solution, recapturing up to 50% of failed and unsolvable recurring payments. Powered by advanced Payment Intelligence, Retain automatically analyzes failed transactions and applies machine learning to resolve them—seamlessly, without subscriber disruption.

With Vindicia Retain, your business protects revenue from both current and future billing cycles because subscribers remain connected to your service. Customers never experience service interruptions, intrusive calls, or disruptive emails—only uninterrupted access.

Vindicia Retain Benefits:

- Optimize Revenue – Recover up to 50% of failed and unsolvable recurring payments.

- Easy-to-Deploy – Go live in days with an intelligent solution that works with any billing system or processor.

- Data-Driven – Leverage actionable insights from over two decades of payments intelligence.

- Top-Level Security – PCI-DSS Level 1 Version 4 compliant and aligned with your business rules.

- Enterprise-Grade – Trusted by leading merchants, processors, and enterprises worldwide.

- Maximize Revenue – Built on payments intelligence from 60+ processors and 1.8B+ transactions.

- Risk-Free – We don’t get paid unless we recover your failed payments.

- Complementary – Designed to fit into existing recovery efforts and payment teams.

How to calculate the benefits of failed payment recovery

Even small improvements in failed payment recovery can have a major impact on recurring revenue. That’s why it’s important to track subscription metrics such as customer lifetime value (CLV), customer acquisition cost (CAC), and the CLV:CAC ratio.

Example: If your subscription business generates $1M in monthly recurring revenue, a 2% improvement in payment recovery equals an additional $20,000 every month—or $240,000 annually—that would otherwise be lost.

To see how incremental recovery improvements translate into long-term growth, try our online revenue calculator. It demonstrates how even modest gains in payment recovery and retention compound over time to deliver substantial ROI.

Continue to explore

Revenue recovery guide to resolve failed credit card transactions for subscription and recurring revenue businesses

Learn more

Customer retention management guide to minimize churn, improve the customer experience, and drive revenue growth.

Learn more